The top 10 best CRMs for wealth managers. They are tailored to the specific needs of financial advisors, wealth managers, and investment professionals. They all offer tools for client management, compliance tracking, reporting, and streamlined communication.

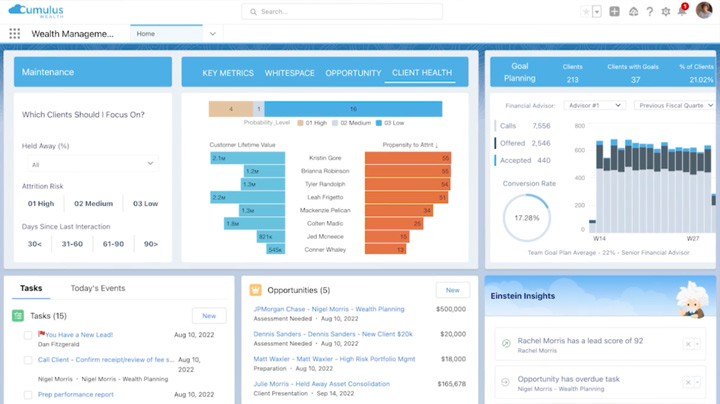

1. Salesforce Financial Services Cloud

Tailored specifically for financial advisors and wealth managers.

Features:

- Client profile management with holistic financial overviews.

- Workflow automation for onboarding and compliance.

- Relationship mapping to track family members and beneficiaries.

- Integration with financial planning and portfolio tools.

Why it works:

- Scalable

- Highly customizable, making it suitable for firms of all sizes.

salesforce.com/financial-services/cloud

2. Redtail CRM

A popular choice among independent financial advisors.

Features:

- Client relationship tracking and note management.

- Workflow automation and reminders.

- Integrations with financial planning software like Orion, Riskalyze, and Morningstar.

- Compliance-ready documentation tools.

- User-friendly and cost-effective, with a focus on small and mid-sized firms.

3. Wealthbox CRM

A simple yet powerful CRM designed specifically for financial advisors.

- Task and workflow automation.

- Social network-style activity streams for team collaboration.

- Easy integration with tools like Zapier, Schwab, and TD Ameritrade.

- Intuitive and clean interface.

- Ideal for small teams looking for an easy-to-use solution.

4. Junxure (by AdvisorEngine)

A CRM purpose-built for financial advisors with a focus on practice management.

Features:

- Advanced workflow automation.

- Comprehensive client reporting and task tracking.

- Integration with custodians and financial planning tools.

- Built-in compliance tools.

Why It’s Great: Excellent for firms that prioritize process management and compliance.

5. Practifi

A CRM platform specifically for financial services firms, including wealth managers.

Features:

- Client segmentation and customized workflows.

- Reporting and analytics tailored to KPIs.

- Multi-team collaboration tools.

- Integration with portfolio management software.

Why It’s Great: Offers a high level of customization for larger firms or multi-team setups.

6. NexJ CRM

A robust CRM platform for financial services, catering to enterprise-level wealth management firms.

Features:

- 360-degree client profiles and relationship hierarchies.

- AI-powered insights and recommendations.

- Integrated compliance tracking.

- Multichannel client engagement tools.

Why It’s Great: Designed for complex wealth management firms needing in-depth client insights.

7. Zoho CRM Plus

A versatile CRM platform with customization options for financial services.

Features:

- Lead and contact management.

- Automation for follow-ups and reminders.

- Integration with third-party tools for financial planning and marketing.

- Analytics for client segmentation and ROI tracking.

Why It’s Great: Affordable and highly customizable for smaller or tech-savvy firms.

8. HubSpot CRM

A general CRM platform with features adaptable to financial services.

Features:

- Client tracking and email integration.

- Marketing automation and content management tools.

- Analytics dashboards for tracking goals.

Why It’s Great: Free basic plan available and great for firms looking to integrate marketing with CRM.

9. Microsoft Dynamics 365 for Financial Services

An enterprise-grade CRM with modules for financial advisors and wealth managers.

Features:

- Client data aggregation and reporting.

- Workflow automation for client onboarding and compliance.

- Integration with Microsoft Office tools and Power BI for analytics.

Why It’s Great: Best for firms already using the Microsoft ecosystem.

10. WealthConnect (built on Salesforce)

A wealth management-specific solution built on Salesforce’s platform.

Features:

- Comprehensive client lifecycle management.

- Compliance tracking and reporting tools.

- Portfolio integration for streamlined data access.

Why It’s Great: Combines the power of Salesforce with features tailored to wealth managers.